TABLE OF CONTENTS:

- From Chief to CDS: Key Dates and Facts

- Why is CHIEF being cancelled?

- What is CDS?

- Steps to transition from CHIEF to CDS

- Summary of Key changes between CHIEF and CDS

- Wrapping Up

From CHIEF to CDS: Key Dates and Facts

If your company trades internationally, you’re probably comfortable with the paperwork by now. However, significant system changes are on the way, so you’ll have to look again or face potential delays.

After nearly 30 years of service, the Customs Handling of Import and Export (CHIEF) system is being phased out and replaced by the Customs Declaration Service (CDS), in two stages. For imports, the transition date will be 30th September 2022 and for exports, 31st March 2023.

This IT system upgrade is critical to meeting the growing demand for Import and Export declarations following Brexit. The move is also consistent with the government’s goal of having the world’s most efficient customs system by 2025, as demonstrated by the offer of flexibility and reliability to trade.

Unlike the previous CHIEF system, the new Customs Declaration Service is “data-craving.” This implies that importers and exporters will be required to supply more information than is presently required for declarations filed using CHIEF.

It also requires much more thought on the part of the declarant, and nothing can be taken for granted with CDS.

Here, we discuss the reasons behind CHIEF’s cancellation, the key features of the new system (CDS), and the steps you need to take to make the transition easier.

Why is CHIEF being cancelled?

CHIEF is one of the world’s largest and most advanced electronic services for managing customs declaration processes. But, at 25 years old, it can’t easily adapt to new requirements.

The decision to replace CHIEF with CDS was made prior to the EU referendum, but subsequent developments have been factored into the planning so that CDS is scaled to handle the increase in the volume of declarations caused by Brexit.

What is CDS?

The Customs Declaration Service (CDS) is a new customs IT platform designed to streamline the process of completing customs declarations for businesses that import or export goods from the United Kingdom.

Described as a system “founded on world-leading technology”, the Government says the single customs service will save businesses time and money in compliance costs.

Regardless of the customer journey, you and your company will be able to declare all goods on one platform at the same time. This will reduce operational costs and the administrative burden of running two separate customs systems.

Declaration data is also clear and available for free – you and your company can easily access real-time import and export data, check tariffs, and financial statements online using dedicated digital dashboards.

Please visit the GOV.UK website for more information on the key differences between how you’ll make declarations on the Customs Declaration Service (CDS) and how it’s currently done on Customs Handling of Imports and Exports Freight (CHIEF).

Meanwhile, if you’re still using CHIEF to make customs declarations for yourself or on behalf of a trader, you need to transfer your declarations to the Customs Declaration Service before CHIEF closes.

Please follow these steps to get ready to use the Customs Declaration Service:

Steps to transition from CHIEF to CDS

Transitioning from CHIEF to CDS is a massive step that requires thoughtful and clever planning on the part of the declarant. The system is more complicated, owing to the fact that certain functions must be performed first on the Government Gateway and then linked to CDS.

If you make declarations on behalf of others or have a badge with a community service provider, it’s highly recommended that you contact them to ensure that they’re preparing for CDS so that you can continue to represent them.

Although the time it’ll take you to migrate to CDS will vary depending on the size and complexity of your business.

However, here are the key elements you must incorporate into your plans.

Step 1: Access to the government gateway

The first step in preparing is to ensure that you have access to the Government Gateway. To do so, you must first obtain a Government Gateway ID through the Gateway portal online here. You must also ensure that you’ve applied for and received a GB EORI (Economic Operators Registration and Identification number).

Step 2: Get CDS service access

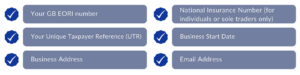

In step two, we look at what additional information you’ll need to gain access to CDS and what that access entails. You’ll be able to see all of your CDS information once you’re in your Government Gateway, but first, you need to provide the following information:

Check that your company’s details, including e-mail addresses on the business tax account are up to date, as these will be required to keep users updated.

Once you have provided the above information:

- You’ll be able to access your financial dashboard

- You’ll also have access to the Secure File Upload Service in case you need to send HMRC supporting documents like licenses or certificates of origin.

Step 3: Understanding the data elements

The third step is all about understanding the new requirements for successfully submitting a customs declaration on CDS. The majority of this information is available in Volume 3 of HMRC’s CDS guidance, or you can contact your broker for more information.

Step 4: Integrating duty payments on CDS

Once you’ve grasped the concept of completion, you can proceed to step four, which is the financials. You can view your balances and payments, as well as give and modify standing authorities for your payment accounts, in the Customs Declaration Service Financial Dashboard.

The following are the payment methods available to you:

1. Deferment account

CDS uses a different HMRC bank account than CHIEF and requires a new CDS Direct Debit Instruction (DDI). This should be implemented as soon as possible.

Note: CHIEF DDI should not be cancelled – it’s used to settle outstanding CHIEF payments.

2. Postponed VAT accounting

If you’re making declarations for yourself and your business is VAT-registered in the United Kingdom, determine whether you can or must account for import VAT on your VAT return.

3. Cash account

These replace the Flexible Accounting System (FAS), and you’ll be assigned one once you’ve registered for the Customs Declaration Service.

4. Immediate payment

These can be done via Bacs, CHAPS, online, or telephone banking – you can pay by debit, corporate credit card, or cheque.

5. Individual guarantees

These can be used to cover customs duties for one-time or high-value imports.

6. General guarantee account

This allows you to provide multiple guarantees from the same account while continuing to import goods into the UK and paying a disputed amount later after an agreement is reached

Step 5: Converting to CDS

Once the above is completed, it’s time to proceed to step 5. At this point, you need to communicate with your software provider to ensure that they’re ready for CDS. If you are not completing the entries yourself, speak with your Customs Agents to determine their suitability.

Summary of Key changes between CHIEF and CDS

While the new changes may appear complicated, understanding CDS isn’t as difficult as you might think. Especially not with the detailed steps outlined above.

Often, the biggest problem with CHIEF is that it can’t easily adapt to new requirements. This differs from CDS, which has significantly more features, including the ability to view previous import and export data on pre-defined reports, check tariffs, review duty deferment statements, and apply for new authorisations and simplifications. It’ll also provide a range of online self-service tools, guides, and checklists.

Other key changes between the two include:

Customs Codes

CHIEF has paper-based rules and uses Community Customs Codes, whereas CDS uses Union Customs Codes and data processing rules.

Procedure Codes

On CHIEF, each goods item has a fixed 7-digit Customs Procedure Code (CPC), whereas, on CDS, procedure codes (PCs) are split into two parts for a single goods item – a 4-digit Procedure Code and up to 99 Additional Procedure Codes (APCs), each with 3 digits.

Data Elements

CHIEF requires up to 68 ‘Boxes’ of information for import declarations (and 45 for export declarations), whereas CDS requires up to 76 ‘Data Elements’ for imports and 65 for exports.

One box in CHIEF can hold multiple pieces of information. However, in CDS, businesses that want to make a declaration must enter this information in separate, specific data elements, so it is critical that businesses understand the different data elements before making a CDS declaration.

Wrapping Up!

Most customs brokers will continue to complete the majority of entries on CHIEF until further notice; but, completing the switchover process now, allows for a smoother transition to CDS before HMRC disables the CHIEF system used for imports in September.

“The decision to switch from CHIEF to CDS demonstrates UK government support by providing a more modernised, flexible and efficient Customs service which is able to handle future changes in technology and increasing volumes in international trade,” says Nigel Clark, our Operations Director, who cautions that there are only a few weeks left, and businesses must act quickly or risk being unable to import goods into the UK after the September deadline.

“While things have settled down post Brexit, there is still work to be done to ensure opportunities are fully realised and most importantly risk of errors are kept to a minimum,” he says.

Our goal is to transition all of our importing customers to the new CDS system as soon as possible so that we’re ahead of the curve before CHIEF is turned off for imports.

As always, we’re here to help all businesses. If you have any concerns about your customs clearances or any other international trade issue, please contact us at +44 (0) 1784 431 081 or via email at info@xpandlogistics.co.uk